Home Equity Conversion FAQs: Everything You Need to Know

HABIL helps seniors leverage their home equity through structured Home Equity Conversion plans, ensuring a steady monthly income to cover the gap between their investment returns and living expenses without depending on their children or liquidating their investments in FD, MF or Equity Shares they had invested before their retirement. Selling their home and moving to a smaller flat or going for JV can be postponed for several years to take advantage of the appreciation of their property.

Mortgages on self-occupied real estate (a house or an apartment) are used to supplement senior citizens' cash flow streams and meet their moderate financial needs. To put it another way, the borrower receives a monthly income (payout) from the bank leveraging the appreciation of their property. There is no monthly EMIs as the appreciation of the property yields income on a monthly basis.

Each bank has a different limit to be offered under Home Equity Conversion payouts based on the value of the property, appreciation, age of the property, and the time duration for which the payouts are required. This is not a life-long payouts as the final settlement is done with funds from children or disposal of other assets or converting the HEC into a regular mortgage by the interested children etc. There are several options including JV redevelopment contract with the empaneled builders. The payout is to bridge the gap between current investment yields and the living expenses to ensure that only as much as it is required to be drawn on a flexible basis is drawn to preserve as much equity in the property at the end of the pre-determined number of years.

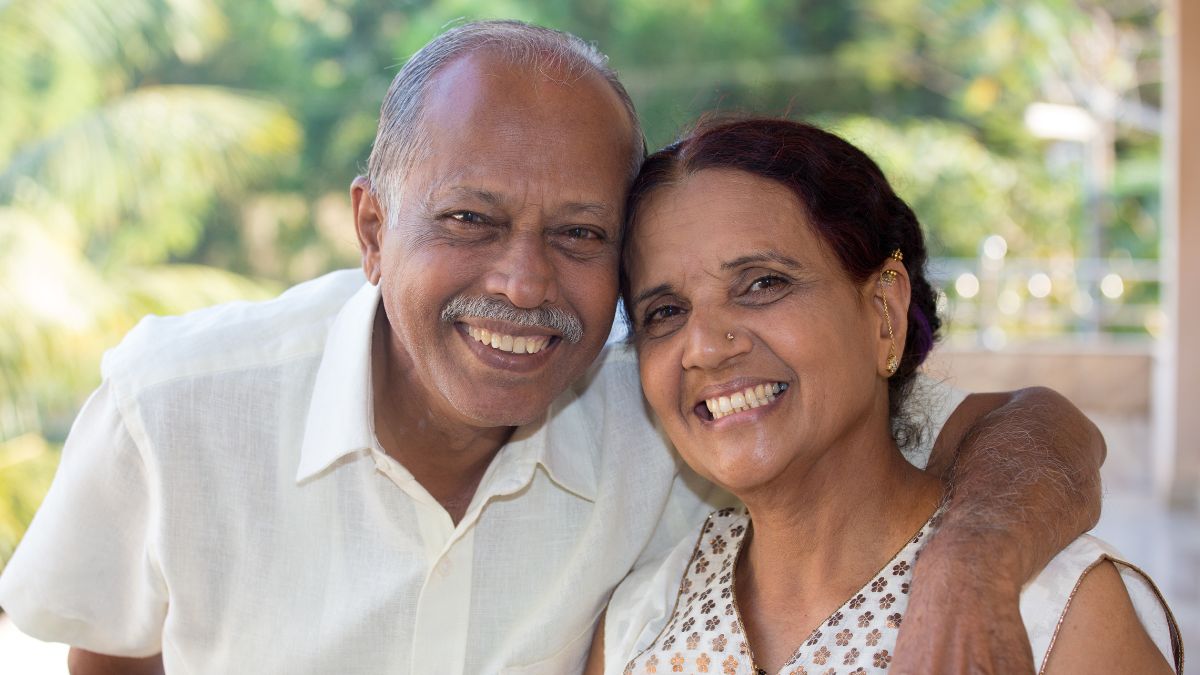

One of the borrowers should be at least 60years of age and the spouse should be at least 55years of age. This is likely to be revised to 55 years based on the recommendations that we have provided to NHB and NITI Aayog. Hopefully there will be wider consultations with all stake holders soon.

Under a home equity conversion, the borrower receives a monthly payout from the bank in exchange for a mortgage on their primary residence. We are trying to relax this clause so that any property owned by the senior citizen or spouse can be leveraged for Home Pension. Where the primary residence is let out for higher rentals and you are staying at a different apartment elsewhere at a lower rental can also be eligible once our recommendations are considered by the authorities.

No

No

Credit score is not a criterion to apply for a home equity conversion loan

You plan how long you would like to receive the payouts under HEC and then take steps to clear the loan as the purpose of leveraging the house property is to get additional income for maintaining your lifestyle. After the loan period is over, the borrower won't lose their property if they pay their total dues (monthly payouts and cumulative interest) in full. HABiL provides guidance to the senior citizens to finalize the number of payouts that they would like to receive in such a way that the appreciation covers the cumulative interest. HABiL with several tie-ups with Retirement Homes / Old Age Homes provide a glide path to the senior citizen to shift to a Retirement Home or redevelop under JV with a builder who undertakes to settle the HEC dues fully and rework the share in the JV. You can choose to receive additional free apartments for rental yields or choose an apartment in the retirement home instead that serves the same purpose of rental income as demand for rentals within Retirement Communities is high and yield is much better.

Property is owned by borrowers. Nevertheless, senior citizen is required to mortgage the property with the lending institutions (Home Finance Companies, banks or NBFCs) and at the end of the agreed period settle the dues to the institutions with various options explained earlier.

This is to be decided upfront as the lender is not the right option to sell the property to recover the loan. Depending on the age, the number of years that HEC payouts to be drawn to be decided so that there is a smooth transition to the Retirement Home chosen based on capital available after appreciation. Children can clear the dues or flip the HEC into regular mortgage or sell or go for JV with the builder who mobilizes funds to clear the dues to take back the document for JV agreement execution.

The loan will get paid back as per the preference of senior citizen/ legal heirs as the period of HEC is decided upfront with the expected total amount due including the cumulative interest. If the decision is to redevelop the property under JV, then the builder / senior citizen arranges to clear the dues and take back the documents from the lender. The share in JV gets reworked as per the loan amount cleared by the builder and senior citizen temporarily moves to another flat as tenant or through HABiL rents an apartment at their preferred Retirement Home providers partnered with our platform: HABiL. The senior citizens move back to their primary apartment built under the JV agreement. Builder acquires a unit in the Retirement Home which is then let out for rental income. If the property is an apartment, then it is sold to a buyer, and the proceeds go to clear the dues to the lender and balance amount is used to buy a smaller apartment as per choice of the senior citizen and legal heirs.

Settlement Deed is the starting point to plan for HCE. It can clearly mention that the legal heirs are not interested in being a party to the transaction. Senior citizens can then decide who would inherit the proceeds after his(spouse’s) demise.

HABiL recommends that the age of the senior citizen at the end of the HEC term is around 75 years and execute agreed glide path for golden years. It may so happen that the senior citizen dies before the end of the original plan under HEC. If the spouse is alive, she can continue to receive reduced payouts under HEC for the original period of the contract if she prefers to continue to live alone. Legal heirs of the deceased borrower can settle the dues and execute the plans as outlined upfront. HABiL foresees all eventualities and safeguards the interest of the Senior Citizen and his spouse. Several options would be outlined that include disposal and invest the proceeds in safe debt products for lifelong returns through a wealth management partner empaneled within HABiL. The pre-agreed plan in the settlement deed will be followed, and the lender releases the property once the loan amount is settled.

Current scenario: No. This is not allowed. This needs to be written in HABiL contract if the family member is the legal heir and inherits the property.

The term of the Home Equity Conversion varies across participating institutions and the value of the property appreciation, age of the senior citizen at the time of entry, vintage of the property etc. The recommended tenure is 15 years or when the senior citizen reaches 75 years. The health of the senior citizens is of prime importance, and how long they want to live in their own property comfortably is our focus. If the couple can manage their daily chores and the household work themselves with the support of a house maid or cook, they can continue under HEC. It is preferrable to move into a Retirement Home or Assisted Living option when they can manage the transition. As it is becoming difficult to get reliable domestic help and manage finances in the cities, it must be factored in decision making.

You do not have to pay interest like the regular Loan Against Property. It is advisable to pay Interest monthly or quarterly as per the options given by the lending institution participating in HABiL. It can be paid at any point in time to reduce the total loan amount to ensure that sufficient equity in the property is available for the Golden Years. Do note that HEC is ideally a supplemental income stream and should not be seen as the major source of income.

If you do not plan to live in your parents' home after their demise and that you and your siblings plan to sell the property, then HEC is ideal to reduce your commitment for regular support. HEC can be a supplemental income to take care of the living expenses of your parents, and you can pay interest alone if you prefer. The support from you will be accounted for within HABiL. At the time of moving out of HEC and planning for Golden Years under various options explained earlier, your financial support with notional interest at the same rate charged by the lender can be factored under the family settlement. The HABiL platform ensures transparency in terms of children’s financial support and keeps track of all contributions received by parents from time to time for ad hoc expenses.